Can executives’ digital background develop the level of AI utilization in enterprises

- Published

- Accepted

- Received

- Academic Editor

- Markus Endler

- Subject Areas

- Human-Computer Interaction, Artificial Intelligence, Emerging Technologies, Text Mining

- Keywords

- Application of digital technology, Artificial intelligence, Executive digital background, High quality development, Total factor productivity

- Copyright

- © 2025 Yu et al.

- Licence

- This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits using, remixing, and building upon the work non-commercially, as long as it is properly attributed. For attribution, the original author(s), title, publication source (PeerJ Computer Science) and either DOI or URL of the article must be cited.

- Cite this article

- 2025. Can executives’ digital background develop the level of AI utilization in enterprises. PeerJ Computer Science 11:e2848 https://doi.org/10.7717/peerj-cs.2848

Abstract

Digital talent has emerged as a pivotal resource for advancing artificial intelligence (AI) within enterprises, and it constitutes a critical digital asset that firms prioritize in their AI development strategies, aiming to attract and retain such talent. To elucidate the interconnections and mechanisms linking the digital backgrounds of executives with the level of AI utilization in enterprises, this study undertakes an examination of the relationship between these two variables, drawing on a sample of Chinese A-share listed companies spanning from 2012 to 2022. The research findings are as follows: (1) The presence of a substantial number of executives with digital backgrounds within a company significantly enhances the development of AI utilization within the enterprise. (2) The influence of executives’ digital backgrounds on the level of AI utilization in enterprises is modulated through the enhancement of the enterprise’s total factor productivity. (3) Executives’ digital backgrounds elevate the level of AI utilization by bolstering their proficiency in applying digital technology. (4) Heterogeneity analysis, conducted based on the nature of enterprise property rights, geographical regions, and technological proficiency, reveals that the positive effect of executives’ digital backgrounds on AI utilization is more pronounced in private enterprises compared to state-owned enterprises. Regionally, the impact of executives’ digital backgrounds on AI utilization diminishes progressively from the eastern to the central and western regions. Robustness checks, including the substitution of key variables, model alteration, the application of the instrumental variable method, and the Heckman two-stage method, confirm the persistence of these findings. This article contributes to the understanding of the impact and pathways through which executives’ digital backgrounds influence AI utilization in enterprises against the backdrop of high-quality economic development. It enriches the scholarly discourse on executives’ digital backgrounds and AI utilization in enterprises, offering both theoretical support and practical insights for the advancement of AI within enterprises.

Introduction

Artificial intelligence (AI) represents a transformative force in the current technological revolution and industrial transformation. Its development facilitates the rapid expansion of high-tech industries and accelerates the momentum of economic growth, holding significant implications for global industrial restructuring and economic development. Enhancing the utilization of AI within enterprises and establishing a robust, secure, and efficient innovation and application system for AI are pivotal in promoting the high-quality development of the global digital economy (Gao, Liu & Yang, 2025). In March 2024, the United Nations adopted its first global resolution on AI, titled “Seizing the opportunities of safe, secure, and trustworthy artificial intelligence systems for sustainable development,” marking a historic consensus on AI application and governance (Isaza Domínguez et al., 2024). AI application serves as a critical enabler for driving high-quality economic growth and fostering the digital transformation of traditional industries. The level of AI utilization within enterprises encompasses multiple dimensions, including personnel, processes, technology, and infrastructure. Among these factors, digital talent directly influences the efficiency of AI technology and infrastructure deployment within organizations, thereby significantly affecting their overall AI utilization levels (Jelenćić et al., 2024). Existing research on digital talent has predominantly concentrated on individual-level characteristics, such as the personal attributes of Chief Information Officers (CIOs) (Cai et al., 2024) and their interactions with other executive team members (Uraon et al., 2023). In recent years, a growing body of studies has begun to explore the impact of the IT background of CEOs (Frost et al., 2023) and signing accountants (Liu et al., 2024) on internal corporate information management. As strategic decisions that involve substantial investments in IT and AI adoption (Song & Hu, 2023), these choices hold profound theoretical and practical significance in investigating whether the digital background of executives can enhance the AI utilization levels of organizations.

Considering these factors, an in-depth exploration of the determinants and interconnected pathways through which the digital backgrounds of executives influence enterprises’ AI utilization levels is of critical importance in advancing the global application and technical proficiency of AI. This study seeks to address several key research questions: (1) What are the determinants through which the digital backgrounds of executives’ impact enterprises’ AI utilization levels? (2) Which elements, when combined, promote AI application within enterprises? (3) What mechanisms influence the effect of executives’ digital backgrounds on AI utilization? These questions require both practical and academic engagement to advance understanding in this domain. To address these research questions, this study proposes a Technology-Organization-Environment (TOE) analytical framework. By integrating contemporary trends and economic development requirements, the TOE framework is refined into three interconnected dimensions: Technology, Organization, and Environment. Within each dimension, specific influencing factors are identified based on relevant theories and empirical research findings.

Compared with existing literature, the potential contributions of this study are as follows: First, existing studies on AI are generally limited in scope and focus predominantly on qualitative explorations of AI concepts and applications, with few studies conducting quantitative analyses of the specific impact of executives’ digital backgrounds from an AI perspective. Against this backdrop, this article addresses two key research questions: (1) It clarifies the specific impact of executives’ digital backgrounds on enterprises’ AI utilization levels and conducts heterogeneity analyses based on factors such as property rights, technological levels, and regional differences, providing targeted policy reference suggestions. (2) It integrates executives’ digital backgrounds, enterprise total factor productivity (TFP), digital technology application, and AI utilization levels into a unified framework, identifying and testing the moderating role of enterprise TFP and the mediating role of digital technology application in the relationship between executives’ digital backgrounds and enterprises’ AI utilization levels. Based on this, this study selects Chinese A-share listed companies from 2012 to 2022 as research samples. By employing the Word2vec technique (Mikolov et al., 2013) and the Skip-gram model, it trains words from annual reports and patent texts as corpora. The Python open-source “jieba” Chinese word segmentation module is utilized to preprocess the annual report texts of listed companies, thereby constructing AI-related variables. In the empirical analysis, this study employs a fixed-effects model for benchmark regression and conducts robustness tests using alternative variable methods, panel Tobit models, and panel Logit models. Additionally, instrumental variable methods and Heckman two-stage methods are applied to address potential endogeneity issues. This study aims to provide empirical evidence on the specific impact of executives’ digital backgrounds on enterprises’ AI utilization levels and the development of enterprises’ AI capabilities.

Materials and Methods

Theoretical analysis and research hypotheses

The substantial development of the digital economy is reshaping the global business landscape, with artificial intelligence (AI) emerging as the core driver of Industry 4.0. According to data from the McKinsey Global Institute, early adopters of AI achieve 2–3 times higher excess returns compared to laggard firms. This reflects the profound impact of executives’ digital literacy on the reconstruction of corporate competitiveness. The technological dividend is accelerating the reconfiguration of the corporate competitiveness map. The application of AI in enterprises holds significant potential for enhancing productivity, improving production efficiency, and driving future technological innovation (Cooper, 2025). Additionally, the management of these enterprises generally possesses digital strategic thinking and technological understanding. Therefore, integrating AI into corporate production and development has become a key driver in corporate management, planning, and operations (Han et al., 2025).

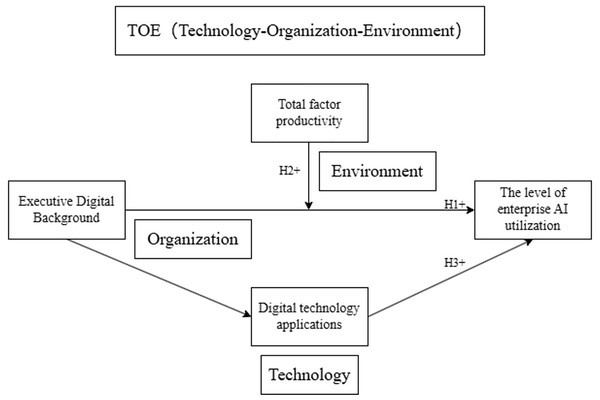

However, when adopting new technologies, enterprises are influenced by three key aspects: technology, organization, and environment, which correspond precisely to the components of the TOE framework (Awa, Ojiabo & Orokor, 2017). How do executives with digital backgrounds comprehensively promote corporate AI application levels across these three dimensions? To address this question, this study explores the impact of executives’ digital backgrounds on corporate AI application levels from three dimensions: (1) the enhancement of corporate digital technology application capabilities under technological preparedness (T) (Zhang, Zhang & Chen, 2024); (2) the digital backgrounds of corporate executives under organizational fit (O) (Pan & Xu, 2024); and (3) the improvement of total factor productivity (TFP) under external environmental regulation (E) (Xiaofei, Yanjuan & Yundi, 2021). The study aims to establish a complete theoretical logic chain of “executive digital background—corporate TFP—AI application level” and “executive digital background—digital technology application capability—AI application level.” This research seeks to reveal the key elements of corporate AI development in the Industry 4.0 era and provide theoretical support for enhancing corporate AI application levels. See Fig. 1 for the specific logic frame diagram.

-

(1)

Executive digital expertise and enterprise artificial intelligence adoption levels

from the organization dimension of the TOE framework, executive digital capabilities constitute a core element of internal AI application within organizations. The digital technological awareness and leadership capabilities of executives directly determine the organizational push for the adoption and application of AI technologies across the enterprise (Bevilacqua et al., 2025). According to Upper Echelons Theory (Hambrick & Mason, 1984), the unique characteristics and experiences of executives shape the manner in which organizations operate, manage, and make strategic decisions. Their professional training also influences decision-making behavior and subsequent biases. On one hand, executives with strong digital capabilities exhibit heightened digital acumen, enabling them to more effectively absorb, process, and apply AI technologies. Their proficiency in utilizing digital tools and platforms allows for a more nuanced understanding of the potential applications of AI across various organizational domains (Bandura, 1977). Drawing on social cognitive theory, executives with robust digital capabilities exert significant influence within the organizational structure, thereby driving the integration and innovation of AI technologies (Bandura, 1987). By implementing AI systems and leveraging their digital expertise, executives not only enhance their own decision-making efficiency but also increase organizational receptivity to AI-driven solutions, thereby amplifying the transformative impact of AI in contemporary business environments (Wei, Zhang & Zhang, 2024). Moreover, Leadership Theory further elucidates the relationship between executive digital capabilities and corporate AI utilization levels. Executives with strong digital capabilities can effectively catalyze organizational change and facilitate the integration of AI technologies (Sahibzada et al., 2024). By championing the potential of AI, these executives motivate employees to embrace AI-driven transformations within the firm and empower them to adopt AI technologies. Based on the above discussion, this study proposes the following hypothesis:

Hypothesis 1: There is a positive correlation between executive digital capabilities and corporate artificial intelligence utilization levels.

-

(2)

Executive digital expertise, total factor productivity, and artificial intelligence utilization in enterprises

From the environment dimension of the TOE framework, the external environment exerts a significant influence on corporate adoption of AI technologies. Information gathering is a critical factor within this dimension. Executives with strong digital backgrounds can leverage the external environment to gather information on technology, market trends, and policies, thereby influencing their technology-related decisions. According to signaling theory, when corporate executives extensively and deeply apply next-generation information technologies, such as AI, in corporate production and operations, they enhance the firm’s information collection capabilities. This effectively broadens the channels through which firms obtain information, mitigates information asymmetry, and promotes transparency through accelerated information flow. Consequently, this reduces production costs, transaction costs, and coordination costs, thereby positively moderating the impact of executives’ digital backgrounds on corporate AI utilization levels. Firstly, executives’ digital backgrounds can alleviate information asymmetry between departments through digital means. Financial management systems, which are based on big data and encompass financial information and production processes across various departments, enable rapid information transmission via networks. This allows firms to adjust and analyze financial information in a timely manner, optimizing AI utilization levels and driving improvements in corporate TFP (Yu & Hamam, 2024). Additionally, from an external perspective, high-quality digital information directly impacts decision-makers’ understanding and assessment of a firm’s financial condition and operational performance (Zhu, 2018). Accurate, reliable, and relevant digital information is crucial for decision-makers to identify opportunities for technological innovation and industrial upgrading, thereby enhancing corporate TFP and promoting AI development (Huang, Shen & Yao, 2024). Based on the above discussion, this study proposes the following hypothesis:

Hypothesis 2: The impact of executives’ digital backgrounds on corporate AI utilization levels is moderated by improvements in corporate total factor productivity (TFP).

-

(3)

Senior executives’ digital backgrounds, digital technology application capabilities, and the level of artificial intelligence utilization in enterprise.

Under the Technological dimension of the TOE framework, executives with digital backgrounds serve as a critical digital talent resource for the application of digital technologies within enterprises. Drawing on Dynamic Capabilities Theory, it is essential for firms to leverage IT resources, organizational resources, and managerial capabilities to achieve competitive advantages. The executive team, as a key digital talent resource, plays a vital role in promoting and driving the application of digital technologies (Wei, Zhang & Zhang, 2024). Given the complex and unstable internal and external environments in which firms develop AI, there are high demands for executives’ digital awareness and digital leadership capabilities. The application of digital technologies has become an innovative process for firms to integrate and restructure internal and external resources, processes, and structures, serving as an important mechanism and trigger for the generation and evolution of dynamic capabilities (Warner & Wäger, 2018). Firms developing AI require business strategies that transcend operational boundaries. Executives with digital backgrounds, leveraging their keen insights into digital trends and industry development, can formulate specific digital technology application strategies based on external digital trends. These strategies can effectively guide the application of digital technologies and enhance corporate AI utilization levels (Yin et al., 2024). With their extensive digital knowledge and experience, executives with digital backgrounds can integrate cutting-edge AI technologies with the firm’s actual situation, oriented by transformational needs, to reduce the risks of failure in digital technology application projects and successfully transform innovative activities into AI outcomes (Yu & Zhu, 2025). For firms, digital technologies themselves do not provide excess returns. However, it has been observed that when digital technologies are appropriately applied to relevant business processes, they steadily promote firm development and generate excess returns. The in-depth application of digital technologies lays the foundation for AI to transform business processes, organizational structures, and innovation models (Yin et al., 2024). Based on the above analysis, this study proposes the following hypothesis:

Hypothesis 3: Executive digital background enhances corporate artificial intelligence utilization level through the improvement of digital technology application capability.

Figure 1: Logical framework diagram of the empirical analysis section of this article.

Results design

-

(1)

Sample selection and data sources

This study selects A-share listed companies on China’s Shanghai and Shenzhen stock markets from 2012 to 2022 as the research population and applies the following screening criteria: Firstly, companies labeled as ST and *ST are excluded. Secondly, listed firms with missing pertinent variables are omitted. Thirdly, by excluding firms that were delisted during the sample period, a total of 29,008 observations are retained for analysis. Additionally, the data processing steps are as follows: Firstly, to mitigate the impact of extreme values on empirical outcomes, all continuous variables are truncated at the 1st and 99th percentiles. Secondly, robust standard errors are employed to address potential issues arising from heteroscedasticity and autocorrelation. The financial indicator data for the control variables are sourced from the CSMAR database.

-

(2)

Variable definition

-

•

Dependent variable: Construction of AI indicators

This study follows the methodology proposed by Li, Wang & Wang (2024) to construct AI indicators by selecting the “generation steps of the Chinese A-shares listed companies’ artificial intelligence dictionary” as follows:

First of all, text extraction and preprocessing: Extract the pure text from the annual reports of Chinese A-shares listed companies, removing tables, numerical data, special symbols, and non-alphabetic characters. Additionally, a stopword list (e.g., “the” and “is”) is used to eliminate nonsensical words.

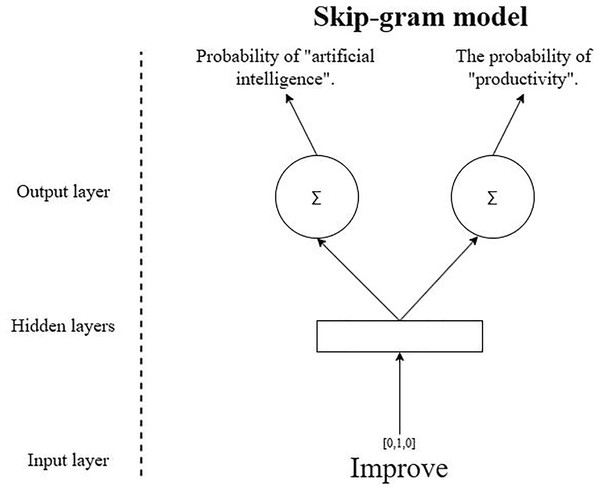

Second, AI-Related terminology construction: Refer to the Chinese translation of “artificial intelligence” (provided by Chen & Srinivasan, 2020) and the English version of the World Intellectual Property Organization (WIPO) AI vocabulary (World Intellectual Property Organization (WIPO), 2024). Use “artificial intelligence” as a seed word and employ the Word2Vec neural network model based on the Skip-gram architecture to obtain the set of semantically similar words. The model of Skip-gram see Fig. 2. Only words with high semantic similarity (e.g., excluding technical company names) are retained.

Third, Vocabulary Refinement: After obtaining the initial set of similar words, eliminate redundant words, words unrelated to AI, and words with low frequency. The final refined vocabulary includes 73 AI-related terms, such as “artificial intelligence,” “AI products,” “AI chips,” “machine translation,” “machine learning,” “computer vision,” “human-machine interaction,” “deep learning,” “neural networks,” “biometric recognition,” “image recognition,” “data mining,” “feature recognition,” “voice synthesis,” “voice recognition,” “knowledge graphs,” “smarter banking,” “smart insurance,” “human-machine collaboration,” “intelligent supervision,” “intelligent education,” “intelligent customer service,” “intelligent retail,” “intelligent agriculture,” “intelligent investment consulting,” “augmented reality,” “virtual reality,” “intelligent healthcare,” “intelligent voice devices,” “intelligent governance,” “intelligent transportation,” “convolutional neural networks,” “voiceprints recognition,” “feature extraction,” “unmanned vehicles,” “intelligent homes,” “question-answering systems,” “face recognition,” “commercial intelligence,” “smart finance,” “recurrent neural networks,” “intelligent agents,” “intelligent elderly care,” “big data marketing,” “big data risk assessment,” “big data analysis,” “big data processing,” “support vector machines (SVM),” “long short-term memory (LSTM),” “robotic process automation (RPA),” “natural language processing (NLP),” “distributed computing,” “knowledge representation,” “intelligent chips,” “wearable products,” “big data management,” “intelligent sensors,” “pattern recognition,” “edge computing," “big data platforms,” “intelligent computing,” “intelligent search,” “internet of things (IoT),” “cloud computing,” “enhanced intelligence,” “voice interaction,” “intelligent environmental protection,” “human-machine dialogue,” and “deep neural networks with big data operational capabilities”.

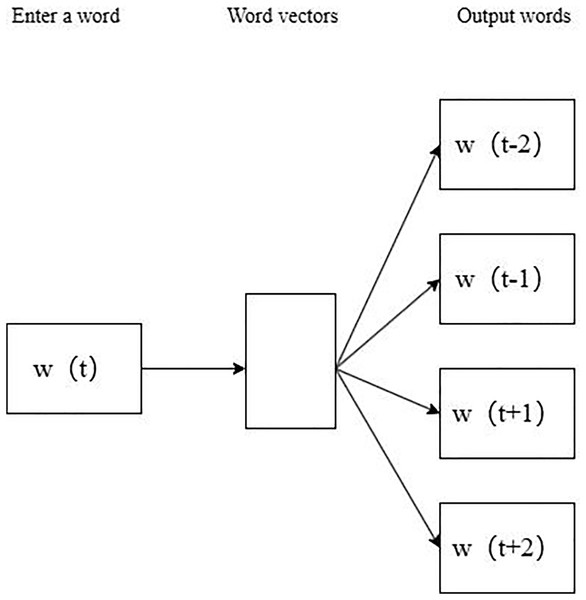

Fourth, text training and word similarity analysis: Refer to Li et al. (2021), utilizing the Word2Vec technique (Mikolov et al., 2013) with the Skip-gram model to train the annual report and patent text materials (see Fig. 3). Based on the cosine similarity between seed words and output words, select the top 10 words most semantically similar to each seed word.

Fifth, vocabulary filtering and finalization: After removing duplicate words, words unrelated to AI, and words with low frequency, a refined vocabulary of 73 AI-related terms is obtained. This vocabulary is then used to construct the AI dictionary for the study.

Finally, text segmentation and analysis: Due to the absence of space-based tokenization in Chinese text and the need for precise word-level language units, Chinese text segmentation presents challenges. We employ the widely-used Python open-source “jieba” (Chinese word segmentation) module to segment the annual report texts. Chinese text segmentation faces three main challenges: appropriate granularity, handling of ambiguous words, and recognition of new words. For instance, “machine learning” is a core AI term, but “jieba” may segment it into “machine” and “learning.” To address this issue, we integrate the pre-defined AI-specific vocabulary into the “jieba” module and conduct segmentation of the annual report texts containing AI-related terms. The number of AI-related keywords in the annual reports, incremented by 1 and then taking the natural logarithm (Lnwords), is adopted as the AI indicator for the study. This methodology ensures the construction of a robust and standardized AI indicator system, tailored to the specific needs of Chinese A-shares listed companies.

-

•

Independent variable: background indicator construction (IT)

This study employs the digital background of executives as the explanatory variable, drawing inspiration from the research conducted by Wu et al. (2022). Specifically, the natural logarithm of the count of executives possessing a digital background within listed companies in the focal year serves as the explanatory variable for the model. The executive team, in this context, exclusively encompasses senior management personnel, excluding members of the board of directors and the supervisory board.

Based on research by Ting et al. (2021), this article manually extracted resume information from annual reports of listed companies disclosed in their resumes. The education background and employment history of executives were collected, and it was identified whether executives possess digital backgrounds. Subsequently, the reliability of the resume information was verified using data from the “Corporate Governance Research” section of the CSMAR database. The assessment of executives’ digital backgrounds is based on two primary facets: their educational backgrounds and employment histories. Educational backgrounds are scrutinized to determine whether senior executives have earned degrees or pursued relevant coursework in fields such as computer science, information science, Internet technology, Big Data, and related disciplines. Employment histories are examined to ascertain whether these executives have engaged in professions within information technology, system development, the Internet, cloud computing, or similar areas, or have held positions within departments such as Information Business, Network Services, Application Software, or have been affiliated with computer associations or institutions. Executives meeting these educational or employment criteria are classified as possessing a digital background.

-

•

Adjusting variable: Constructing total factor productivity indicators for enterprises

TFP represents the rate of output growth attributed to factors beyond capital and labor inputs in enterprise production processes (Wen & Deng, 2024). When estimating TFP using the Cobb-Douglas (C-D) production function and ordinary least squares (OLS) regression, potential selection bias issues may arise. To mitigate these biases, the semi-parametric approach, commonly referred to as the LP method, can be employed, as it diminishes the errors inherent in the OLS methodology. Specifically, the LP method proxies enterprise productivity using intermediate inputs and their variations as indicators of productivity shifts. In this study, we adopt the LP method to calculate TFP for enterprises, treating it as a moderating variable in our analysis.

-

•

Mediating variable: Constructing an index for digital technology application capability (DAT)

This article follows the methodology outlined by Shi, Niu & Xu (2023), which quantifies a company’s digital technology application capability by aggregating the number of mentions of digital technology application indicators in its annual financial reports. Specifically, the frequency of keywords pertaining to the enterprise’s digital technology application capability in these reports serves as a proxy for the company’s proficiency in applying digital technology. A higher frequency of such keywords indicates a stronger capability in digital technology application.

-

•

Control variable selection

Based on existing research, this article selects a range of financial indicators and corporate governance variables as control variables. These include company size (Size), book-to-market ratio (BM), return on assets (ROA), management shareholding ratio (Mshare), gross profit margin (GrossProfit), top three shareholder shareholding ratios (Top 3), quick ratio (Quick), management expense ratio (Mfee), fixed asset ratio (Fixed), and audit fees (AuditFee). Definitions for all variables utilized in this study are presented in Table 1.

-

(3)

Model settings

To verify hypothesis 1, this article constructs the following model to examine the impact of executive digital background on the utilization level of artificial intelligence in enterprises

-

(1)

(2)

(3)

(4)

Figure 2: Skip-gram model of the empirical analysis section of this article.

Figure 3: Introduction to skip gram model of the empirical analysis section of this article.

| Variable | Variable symbol | Variable definition | |

|---|---|---|---|

| Dependent variable | Enterprise artificial intelligence utilization level | AI | (Enterprise AI Utilization Level Annual Report Disclosures Keywords+1) and then take the natural logarithm |

| Independent variable | Executive digital background | IT | Take the natural logarithm after adding 1 to the number of executives with a numerical background |

| Mediating variable | Ability to apply digital technology | DTA | (Enterprise digital technology application capability annual report disclosure keywords+1) and then take the natural logarithm |

| Adjusting variables | Total factor productivity of enterprises | TFP | Richardson inefficient investment model |

| Control variable | Company size | Size | Natural logarithm of annual total assets |

| book-to-market | BM | Book value/total market value | |

| Net profit margin of total assets | ROA | Net profit/average balance of total assets | |

| Management shareholding ratio | Mshare | Management shareholding/total share capital | |

| Sales gross profit margin | GrossProfit | (Main business income—Main business cost)/Main business income | |

| Shareholding ratio of the top three major shareholders | Top3 | Number of shares held by the top three major shareholders/total number of shares | |

| Quick ratio | Quick | (Current Assets—Inventory)/Current Liabilities | |

| Management expense ratio | Mfee | Management expenses/operating income | |

| Proportion of fixed assets | Fixed | Net fixed assets to total assets ratio | |

| Audit fees as a percentage of fixed assets | AuditFee | Audit fees are calculated using the natural logarithm |

Note:

The variable definition table of the empirical analysis section of this article.

In this study, the explanatory variable is the level of enterprise artificial intelligence utilization (AI). The primary focus, or core explanatory variable, is the executive’s digital background (IT). Additionally, a binary variable (IT_dummy) is introduced in the regression analysis to indicate the presence or absence of an executive with a digital background in the enterprise. Controls are a series of other variables that may have an impact on the level of AI utilization in the executive’s digital background, along with the introduction of annual dummy variables ( ) and individual dummy variables ( ).

To verify hypothesis 2, this article establishes the following moderation effect model to examine the moderating influence of total factor productivity on the relationship between executives’ digital backgrounds and the level of artificial intelligence utilization within enterprises.

(5)

To verify hypothesis 3, this article consults the two-step approach proposed by Jiang (2022) and constructs the following mediation effect model to test the mediating effect of digital technology application on the impact of executive digital background on the level of artificial intelligence utilization in enterprises. The following model is set up:

(6)

(7)

Results

Empirical results and analysis

-

(1)

Descriptive statistics

The descriptive statistics for the primary variables in this study are presented in Table 2. According to Table 2, the mean value of the executives’ digital background (IT) in the sample data-set is 0.134, with a minimum of 0 and a maximum of 2.485. Both the standard deviation and variance are under 1, suggesting that the variability in the level of executives’ digital backgrounds among the sampled companies is relatively low. The enterprise artificial intelligence (AI) variable ranges from a minimum of 0 to a maximum of 1, exhibiting a mean of 0.132 and a median of 0. The measured values of the other variables do not exhibit significant disparities.

-

(2)

Benchmark regression

This article uses a fixed effects model to conduct benchmark regression on each variable. Columns (1) and (2) in Table 3 represent the regression results of executive digital background (IT) on the utilization level of artificial intelligence (AI) in enterprises without introducing control variables and with all control variables added, respectively. The regression results in each column of Table 3 show that regardless of whether control variables are added or not, the impact of executive digital background on the utilization level of AI in enterprises is positively significant at the 1% level, indicating that enterprises with more executives with digital backgrounds are better able to develop their AI utilization level, verifying hypothesis 1. In addition, this article further regresses the relationship between whether a company has digital background executives and its level of artificial intelligence utilization. Regardless of whether control variables are added, the impact of whether a company has digital background executives on its level of artificial intelligence utilization is positively significant at the 5% level, further confirming hypothesis 1.

-

(3)

Mechanism verification

-

•

Adjustment effect—total factor productivity

The results of the moderation effect analysis are displayed in Table 4. To mitigate potential collinearity concerns among the independent variables, which could induce model estimation biases, this study centered the independent variables. The interaction term between executives’ digital background and total factor productivity, presented in column (1), is statistically significant at the 1% level and displays a positive coefficient. This finding indicates that total factor productivity positively moderates the relationship between executives’ digital background and the level of artificial intelligence utilization in enterprises, thus supporting hypothesis 2. Exploring the potential reasons, it could be postulated that enterprises with higher total factor productivity are more inclined to enhance their artificial intelligence utilization. Furthermore, by improving total factor productivity, enterprises can allocate more resources towards internal governance and high-quality sustainable development. Consequently, enterprise assets are allocated more reasonably, and the business environment is substantially enhanced, thereby amplifying the positive influence of executives’ digital background on the advancement of artificial intelligence utilization. Additionally, enterprises with higher total factor productivity are likely to have executives with digital backgrounds who exhibit greater attention to the level of artificial intelligence utilization within the organization.

-

•

Mediating effect—level of digital technology application

This article employs the mediation effect analysis methodology outlined by Jiang (2022) to initially investigate the influence of executives’ digital backgrounds on the level of digital technology application. The regression results presented in column (2) of Table 4 indicate that the impact of executives’ digital backgrounds on the level of digital technology application is statistically significant and positive at the 1% level, suggesting that the incorporation of executives with digital backgrounds can elevate the level of digital technology application in enterprises by approximately 9.0%. The outcomes in column (3) of Table 4 further reveal that the application level of digital technology has a significant and positive effect on the application level of artificial intelligence in enterprises at the 1% level, indicating that the improvement in digital technology application acts as a mediator between executives’ digital backgrounds and the utilization level of artificial intelligence in enterprises. In essence, the digital backgrounds of executives augment the application level of digital technology, thereby enhancing the utilization level of artificial intelligence in enterprises. Thus, Hypothesis 3 is supported.

Exploring the underlying reasons, it is plausible that executives with digital backgrounds possess a greater propensity to adopt digital technology. The implementation of digital technology enables employees to witness the efficacy of artificial intelligence applications, thereby setting a precedent and providing a demonstration for the development and further research and development of next-generation artificial intelligence. Consequently, this fosters the deeper integration and application of artificial intelligence within enterprises.

-

| Variable | Sample size | Mean value | Minimum value | Maximum value | Median | Standard deviation | Variance |

|---|---|---|---|---|---|---|---|

| IT | 29,267 | 0.134 | 0.000 | 2.485 | 0.000 | 0.374 | 0.140 |

| AI | 29,267 | 0.132 | 0.000 | 1.000 | 0.000 | 0.339 | 0.115 |

| Size | 29,267 | 22.260 | 15.580 | 28.640 | 22.080 | 1.325 | 1.756 |

| BM | 29,267 | 0.624 | 0.001 | 1.601 | 0.621 | 0.255 | 0.065 |

| ROA | 29,267 | 0.040 | −2.285 | 12.210 | 0.037 | 0.135 | 0.018 |

| Mshare | 29,267 | 12.750 | 0.000 | 89.990 | 0.532 | 19.040 | 362.500 |

| GrossProfit | 29,267 | 0.284 | −2.978 | 3.764 | 0.253 | 0.182 | 0.033 |

| Top3 | 29,267 | 0.478 | 0.006 | 0.975 | 0.472 | 0.155 | 0.024 |

| Quick | 29,267 | 1.987 | −5.132 | 179.600 | 1.211 | 3.192 | 10.190 |

| Mfee | 29,267 | 0.002 | −0.008 | 21.150 | 0.001 | 0.124 | 0.015 |

| Fixed | 29,267 | 0.213 | 0.000 | 0.971 | 0.181 | 0.161 | 0.026 |

| AuditFee | 29,267 | 13.720 | 11.510 | 17.950 | 13.590 | 0.667 | 0.445 |

Note:

The descriptive statistics table of the empirical analysis section of this article.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| AI | AI | AI | AI | |

| IT | 0.113*** | 0.103*** | ||

| (3.688) | (3.483) | |||

| IT_dummy | 0.050** | 0.045** | ||

| (2.519) | (2.284) | |||

| Size | 0.137*** | 0.137*** | ||

| (11.083) | (11.085) | |||

| BM | −0.092** | −0.093** | ||

| (−2.367) | (−2.390) | |||

| ROA | −0.073 | −0.073 | ||

| (−1.641) | (−1.636) | |||

| Mshare | −0.001** | −0.001** | ||

| (−2.090) | (−2.067) | |||

| GrossProfit | −0.113*** | −0.113*** | ||

| (−2.597) | (−2.598) | |||

| Top3 | −0.597*** | −0.598*** | ||

| (−8.318) | (−8.334) | |||

| Quick | −0.011*** | −0.011*** | ||

| (−3.163) | (−3.152) | |||

| Mfee | 0.016*** | 0.016*** | ||

| (3.362) | (3.399) | |||

| Fixed | −0.150*** | −0.152*** | ||

| (−3.523) | (−3.578) | |||

| AuditFee | 0.081*** | 0.082*** | ||

| (5.065) | (5.105) | |||

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Constant | 0.336*** | −3.366*** | 0.345*** | −3.391*** |

| (24.289) | (−13.041) | (26.774) | (−12.999) | |

| N | 27,009 | 27,009 | 27,009 | 27,009 |

| Adj. R2 | 0.624 | 0.638 | 0.623 | 0.637 |

Notes:

The benchmark regression table of the empirical analysis section of this article.

***, **, * respectively indicate significance at the levels of 0.01, 0.05, and 0.1.

| (1) | (2) | (3) | |

|---|---|---|---|

| DTA | AI | AI | |

| IT | 0.101*** | 0.103*** | |

| (4.366) | (3.471) | ||

| DTA | 0.114*** | ||

| (13.008) | |||

| TFP | 0.018* | ||

| (1.788) | |||

| Interact | 0.164*** | ||

| (8.288) | |||

| Size | 0.147*** | 0.121*** | 0.128*** |

| (10.019) | (10.151) | (9.592) | |

| BM | −0.176*** | −0.073* | −0.086** |

| (−4.392) | (−1.918) | (−2.201) | |

| ROA | −0.014 | −0.072* | −0.084* |

| (−0.424) | (−1.657) | (−1.752) | |

| Mshare | 0.000 | −0.001** | −0.001* |

| (0.045) | (−2.049) | (−1.871) | |

| GrossProfit | −0.038 | −0.108** | −0.113** |

| (−0.780) | (−2.549) | (−2.493) | |

| Top3 | −0.273*** | −0.567*** | −0.560*** |

| (−3.568) | (−7.999) | (−8.036) | |

| Quick | −0.004 | −0.010*** | −0.009*** |

| (−1.387) | (−3.205) | (−2.827) | |

| Mfee | 0.007 | 0.016*** | 0.015*** |

| (0.546) | (2.953) | (3.118) | |

| Fixed | −0.359*** | −0.112*** | −0.121*** |

| (−6.289) | (−2.735) | (−2.847) | |

| AuditFee | 0.078*** | 0.073*** | 0.076*** |

| (3.777) | (4.683) | (4.654) | |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Constant | −3.096*** | −3.044*** | −3.288*** |

| (−9.210) | (−12.551) | (−13.149) | |

| N | 27,009 | 27,009 | 26,591 |

| Adj. R2 | 0.708 | 0.645 | 0.638 |

Notes:

The mediation effect and moderation effect table of the empirical analysis section of this article.

***, **, * respectively indicate significance at the levels of 0.01, 0.05, and 0.1.

Robustness test and endogeneity test

-

(1)

Robustness test: benchmark regression replacing the dependent variable

In this article, the explanatory variable, which originally represented whether the enterprise adopts artificial intelligence (denoted as AI_Dummy), is replaced with a binary variable reflecting the same concept and reintroduced into the regression model. The regression outcomes following this substitution are presented in columns (1) and (2) of Table 5. Specifically, the results demonstrate significance at the 1% level for the impact of executives’ digital backgrounds on whether the enterprise adopts artificial intelligence, both in the absence and presence of control variables. Notably, the regression results obtained by substituting the enterprise’s level of artificial intelligence utilization (AI) with the binary AI_Dummy variable align consistently with the baseline findings. This consistency underscores the robustness and reliability of the conclusion drawn.

-

(2)

Robustness test: baseline regression after replacing the regression model

The binary variable values of the artificial intelligence (AI_Dummy) constructed in this article are [0,1], which belong to the restricted dependent variable. In view of this, this article further constructs panel Tobit model and panel Logit Model to analyze the effect of executive digital background on the utilization level of artificial intelligence in enterprises. The regression results are shown in columns (3)–(6) of Table 5. Without adding control variables or adding all control variables, the regression results of the panel Tobit model and panel Logit Model are significant at the 1% level, consistent with the benchmark results, indicating that the conclusion is robust and reliable.

-

(3)

Endogeneity test

-

•

Instrumental variable method

This article consults the approach of Li & Qi (2011) and selects the lagged executive numerical background as the instrumental variable to estimate model (3). The regression results are shown in columns (1)–(2) of Table 6. The results show that there is no substantial difference between the regression coefficients of executive digital background and the level of artificial intelligence utilization in enterprises, as well as the regression coefficients of control variables, and the benchmark regression results. This also indicates that the conclusion that executive digital background has a positive promoting effect on the level of artificial intelligence utilization in enterprises is robust.

-

•

Heckman two-stage method

The influence of executives’ digital backgrounds on the level of artificial intelligence (AI) utilization within enterprises involves two sequential decision-making processes: the first pertains to the count of executives possessing digital backgrounds within the enterprise, and the second concerns the adoption of AI by the enterprise. Initially, a Probit model is employed to establish a selection equation for executives’ digital backgrounds. This model is utilized to estimate the inverse Mills ratio of the enterprise’s AI utilization level, which is subsequently incorporated as an instrumental variable to address sample selection bias. This instrumental variable, along with other independent variables, forms the basis for constructing the outcome equation. Regression analysis is then conducted on the enterprise’s AI utilization level, with the regression results presented in columns (3) and (4) of Table 6. Notably, the results indicate no substantial divergence between the Heckman two-stage model and the benchmark regression outcomes. This consistency further validates the robustness of the conclusion that executives’ digital backgrounds positively enhance the level of AI utilization within enterprises.

-

| (1) Ols | (2) Ols | (3) Tobit | (4) Tobit | (5) Logit | (6) Logit | |

|---|---|---|---|---|---|---|

| AI_dummy | AI_dummy | AI_dummy | AI_dummy | AI_dummy | AI_dummy | |

| IT | 0.042*** | 0.038*** | 0.207*** | 0.173*** | 1.425*** | 1.253*** |

| (3.197) | (2.961) | (29.947) | (25.199) | (10.985) | (10.494) | |

| Size | 0.060*** | 0.017*** | 0.172*** | |||

| (10.027) | (5.998) | (2.599) | ||||

| BM | −0.045** | −0.143*** | −0.961*** | |||

| (−2.323) | (−12.528) | (−4.194) | ||||

| ROA | −0.026 | −0.083*** | −1.100*** | |||

| (−1.396) | (−3.251) | (−2.842) | ||||

| Mshare | −0.000 | 0.001*** | 0.015*** | |||

| (−0.877) | (7.976) | (4.426) | ||||

| GrossProfit | −0.058*** | 0.038*** | 0.572* | |||

| (−2.770) | (3.210) | (1.890) | ||||

| Top3 | −0.253*** | −0.150*** | −1.675*** | |||

| (−8.285) | (−11.254) | (−4.367) | ||||

| Quick | −0.005*** | 0.001 | −0.015 | |||

| (−3.241) | (1.331) | (−1.281) | ||||

| Mfee | 0.009*** | −0.004*** | −24.183** | |||

| (4.208) | (−3.634) | (−2.200) | ||||

| Fixed | −0.079*** | −0.294*** | −5.210*** | |||

| (−3.461) | (−27.106) | (−12.519) | ||||

| AuditFee | 0.032*** | 0.036*** | 0.547*** | |||

| (4.101) | (8.170) | (4.551) | ||||

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.147*** | −1.447*** | −0.006** | −0.639*** | −8.819*** | −17.105*** |

| (25.767) | (−11.777) | (−2.098) | (−13.354) | (−20.235) | (−12.655) | |

| var(e.AI_dummy) | 0.115*** | 0.110*** | ||||

| (96.714) | (99.237) | |||||

| lnsig2u | 2.398*** | 2.183*** | ||||

| (38.007) | (35.502) | |||||

| N | 27,009 | 27,009 | 29,267 | 29,267 | 29,267 | 29,267 |

| Adj. R2 | 0.473 | 0.484 |

Notes:

The robust test table of the empirical analysis section of this article.

***, **, * indicate significance at the levels of 0.01, 0.05, and 0.1, respectively.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| IT | AI | AI_dummy | AI | |

| l_IT | 0.901*** | |||

| (177.402) | ||||

| IT | 0.561*** | 0.614*** | 0.081*** | |

| (25.318) | (11.872) | (18.739) | ||

| Imr | −2.753*** | |||

| (−408.653) | ||||

| Size | 0.000 | 0.017*** | 0.152*** | −0.003 |

| (0.135) | (2.669) | (5.301) | (−1.533) | |

| BM | −0.007 | −0.190*** | −0.513*** | −0.025*** |

| (−1.282) | (−8.219) | (−5.490) | (−3.010) | |

| ROA | 0.018 | −0.480*** | −0.354** | −0.044*** |

| (1.221) | (−5.683) | (−2.004) | (−3.688) | |

| Mshare | 0.000*** | 0.003*** | 0.009*** | −0.000 |

| (3.169) | (9.898) | (6.799) | (−0.167) | |

| GrossProfit | −0.003 | 0.278*** | 0.103 | 0.084*** |

| (−0.435) | (9.110) | (0.825) | (8.972) | |

| Top3 | −0.012* | −0.513*** | −0.459*** | −0.115*** |

| (−1.732) | (−15.827) | (−2.889) | (−11.063) | |

| Quick | 0.000 | 0.003* | −0.005 | −0.000 |

| (0.183) | (1.757) | (−0.820) | (−0.082) | |

| Mfee | 2.179** | −10.272*** | −12.203 | −0.004 |

| (2.238) | (−3.416) | (−1.325) | (−0.293) | |

| Fixed | −0.028*** | −0.773*** | −2.047*** | −0.030*** |

| (−4.811) | (−31.047) | (−12.948) | (−2.930) | |

| AuditFee | −0.001 | 0.191*** | 0.227*** | 0.016*** |

| (−0.283) | (18.377) | (4.649) | (4.637) | |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Constant | 0.026 | −2.264*** | −8.801*** | 2.099*** |

| (1.006) | (−19.758) | (−15.492) | (54.547) | |

| lnsig2u | ||||

| 0.733*** | ||||

| N | (15.742) | |||

| Adj. R2 | 24,909 | 24,909 | 29,267 | 29,267 |

| Constant | 0.813 | 0.156 | 0.883 |

Notes:

The endogeneity test table of the empirical analysis section of this article.

***, **, * indicate significance at the levels of 0.01, 0.05, and 0.1, respectively.

Further analysis

-

(1)

Heterogeneity of property rights

Enterprises with diverse property rights exhibit varying priorities in operational efficiency, where private enterprises demonstrate a greater emphasis on their internal resource allocation efficiency compared to state-owned enterprises. The heterogeneity in property rights significantly influences enterprises’ resource allocation and strategic decision-making processes. To investigate the impact of executives’ digital backgrounds on the level of AI utilization within enterprises, stratified by property rights, this study classifies enterprises into private and state-owned categories based on their operational autonomy for sample regression analysis. The regression results, presented in columns (1) and (2) of Table 7, reveal that the influence of executives’ digital backgrounds on AI utilization in private enterprises is statistically significant at the 1% confidence level, whereas the corresponding impact in state-owned enterprises is significant at the 10% confidence level. This suggests that, due to the heterogeneity in property rights, the influence of executives’ digital backgrounds on AI utilization is more pronounced in private enterprises. Given that private enterprises independently invest, operate, profit from, and bear operational risks, they are more adept at converting their digital talent advantages into enhanced AI utilization levels compared to state-owned enterprises.

-

(2)

Heterogeneity of technological level

In the realm of the digital economy, the incorporation of executives with digital backgrounds represents an inevitable strategy for high-tech enterprises to confront the emerging challenges posed by AI. High-tech enterprises, being at the forefront of advanced concepts and technological innovations, foster a robust digital cultural milieu. Furthermore, technological innovation constitutes the core competitiveness of these enterprises, endowing them with a potent subjective inclination and objective capability to advance AI development. Additionally, industry-specific pressures necessitate that high-tech enterprises prioritize AI development to a greater extent than non-high-tech enterprises. Amidst the pervasive industry pressure to adopt AI, high-tech enterprises expedite their AI application timelines to adhere to regulatory standards. Consequently, high-tech enterprises possess a compelling impetus to recruit executives with digital backgrounds and accelerate AI implementation. The digital expertise of these executives facilitates the sharing of digital technologies and resources, enhances the integration of internal and external AI resources and capabilities, and promotes the adoption of AI. Given this context, this study anticipates that executives with digital backgrounds will exert a more potent stimulative effect on the utilization level of AI within high-tech enterprises. To test this hypothesis, the sample is stratified into high-tech and non-high-tech enterprises. The regression results, presented in columns (3) and (4) of Table 7, indicate that the regression coefficient for the digital background of executives in the high-tech enterprise group is significantly positive, whereas it is insignificant in the non-high-tech enterprise group. This finding suggests that the digital background of executives solely empowers AI application within high-tech enterprises, aligning with our expectations.

-

(3)

Regional heterogeneity

Previous studies have suggested that location is an important factor affecting the development of artificial intelligence in enterprises (Huang, Bai & Luo, 2024). Overall, if enterprises from different regions have location advantages, due to China’s vast territory, there are significant differences in resource endowment (Yang et al., 2023), business environment (Lu et al., 2024), economic foundation (Amir, Erickson & Jin, 2017), digital infrastructure (He et al., 2024) and other aspects among different regions. There are also significant differences in the number of digital executives and the level of artificial intelligence utilization among enterprises (Wen & Deng, 2024). This article divides 272 prefecture level cities into eastern, central, and western regions. By introducing location indicators to expand the benchmark model, it explores the differences in the impact of executive digital backgrounds on the level of artificial intelligence utilization in enterprises in different regions. The empirical results, as shown in columns (5)–(7) of Table 7, show that the impact of the number of digital executives on the level of artificial intelligence utilization is not significant in the western region, but is significantly positively correlated at the 10% level in the central region and at the 1% level in the eastern region. This indicates that the positive impact of executive digital backgrounds on the level of artificial intelligence utilization in enterprises increases from the western region to the eastern region.

-

(4)

Influence of external factors

To examine the impact of external factors such as regulatory levels, industry changes, and cultural differences on the relationship between executives’ digital backgrounds and the application of artificial intelligence (AI) in firms. Based on the industry classification standards of the China Securities Regulatory Commission (CSRC) in 2012, the sample industries are categorized into three types according to the intensity of production factors: technology-intensive industries, capital-intensive industries, and labor-intensive industries. To achieve this classification, the study utilizes Ward’s linkage method in cluster analysis, a widely employed technique in cluster analysis with a fixed number of categories. This method minimizes within-group differences while maximizing between-group differences among the samples. Specifically, industries are initially classified as capital-intensive based on the proportion of fixed assets, reflecting a higher emphasis on capital. Second, industries with a higher ratio of R&D expenditure to employee compensation are designated as technology-intensive, as this indicates that technological research and development are more critical to the firm than labor factors. The remaining industries are categorized as labor-intensive. The classification results for the 67 sub-industries included in the sample are presented in Table 8. The findings reveal that there are more labor-intensive industries in the sample of listed companies, yet the industries with higher levels of AI application remain the technology-intensive ones.

In accordance with the aforementioned methodology, this article classifies firms into three categories—technology-intensive, capital-intensive, and labor-intensive—based on differences in production factors. The study investigates the impact of external factors such as regulatory levels, industry changes, and cultural differences on the relationship between executives’ digital backgrounds and the utilization of artificial intelligence (AI) in firms. The empirical results are presented in Table 9, which demonstrates that the positive impact of executives’ digital backgrounds on AI utilization is stronger in technology-intensive industries (p < 0.01), weaker in labor-intensive industries (p < 0.10), and insignificant in capital-intensive industries (p > 0.05). These findings highlight the varying degrees to which external factors influence the relationship between executives’ technological awareness and AI adoption across different industry types.

From the perspective of external regulation, data assets in technology-intensive industries are typically subject to stricter regulatory oversight, particularly in areas such as data privacy, technological security, and intellectual property protection (Chen et al., 2025). Executives with a digital background are better equipped to understand regulatory requirements and promote the application of AI within a compliant framework (El-Gohary & Aziz, 2014). As a result, the impact of executives’ digital backgrounds on AI utilization is significant at the 10% significance level. In contrast, regulatory focus in labor-intensive industries is usually centered on labor protection and workplace safety, rather than technological application. Therefore, the role of executives’ digital backgrounds in promoting AI application is weaker, being significant only at the 1% significance level. In capital-intensive industries, regulatory emphasis is on environmental protection, resource utilization, and equipment safety, where the application space for AI is relatively limited (Sandu, Varganova & Samii, 2023).

From the perspective of industry differences, the core competitive advantage in technology-intensive industries lies in technological innovation, with AI being a key tool for maintaining competitiveness (Zhang & Peng, 2025). Executives with a digital background can better integrate technological resources and drive the deep application of AI in research and development, production, and management. Hence, the impact of executives’ digital backgrounds on AI application is significant at the 1% significance level. In labor-intensive industries, business models rely on human resources and standardized processes (Liu & Zhang, 2022), with AI applications primarily focused on automation and efficiency improvements (Zhai & Liu, 2023). Due to industry characteristics, the depth of AI application is limited, and the role of executives’ digital backgrounds is weaker, being significant only at the 10% significance level. In capital-intensive industries, business models depend on the economies of scale of fixed assets (Aghabegloo et al., 2024), and the role of executives’ digital backgrounds in promoting AI application is not significant.

From the perspective of corporate culture, technology-intensive industries typically have an innovation-driven cultural atmosphere with a higher acceptance of new technologies within the organization (Secundo et al., 2020). Executives with a digital background can align with this culture and facilitate the rapid implementation and application of AI. Therefore, the impact of executives’ digital backgrounds on AI application is significant at the 1% significance level. In labor-intensive industries, corporate culture tends to emphasize operational stability rather than technological innovation (Boppart, Krusell & Olsson, 2023). In capital-intensive industries, the culture focuses more on asset operation and cost control, with technological innovation not being a core concern (Buck et al., 2023).

In summary, this study classifies firms into three types—technology-intensive, capital-intensive, and labor-intensive—based on differences in production factors. The research investigates the impact of external factors such as regulatory levels, industry changes, and cultural differences on the relationship between executives’ digital backgrounds and the utilization of AI in firms. The findings indicate that the positive impact of executives’ digital backgrounds on AI utilization is stronger in technology-intensive industries, weaker in labor-intensive industries, and insignificant in capital-intensive industries. These results highlight the varying degrees to which external factors influence the relationship between executives’ technological awareness and AI adoption across different industry types.

| (1) Private enterprise | (2) State-owned enterprise | (3) Non high tech | (4) High-tech | (5) Western region | (6) Central region | (7) Eastern region | |

|---|---|---|---|---|---|---|---|

| AI | AI | AI | AI | AI | AI | AI | |

| IT | 0.093*** | 0.079* | 0.064 | 0.089** | 0.029 | 0.122** | 0.106*** |

| (2.683) | (1.937) | (1.213) | (1.979) | (0.438) | (2.242) | (3.148) | |

| Size | 0.129*** | 0.139*** | 0.103*** | 0.161*** | 0.138*** | 0.069*** | 0.155*** |

| (8.632) | (7.618) | (5.179) | (7.034) | (6.757) | (3.605) | (10.041) | |

| BM | −0.068 | −0.059 | −0.035 | −0.047 | −0.067 | 0.019 | −0.122*** |

| (−1.367) | (−1.226) | (−0.858) | (−0.926) | (−1.078) | (0.352) | (−2.822) | |

| ROA | −0.044 | −0.307*** | −0.012 | −0.144 | −0.256*** | −0.015 | −0.058 |

| (−1.157) | (−4.224) | (−0.905) | (−1.433) | (−2.799) | (−0.256) | (−1.230) | |

| Mshare | −0.001 | −0.018*** | −0.001 | −0.001 | 0.004*** | −0.002 | −0.001 |

| (−0.897) | (−4.346) | (−0.693) | (−0.584) | (2.604) | (−1.232) | (−1.483) | |

| Gross Profit | −0.178*** | 0.029 | 0.052 | −0.302*** | −0.249** | −0.004 | −0.105* |

| (−3.294) | (0.493) | (1.125) | (−2.843) | (−2.404) | (−0.071) | (−1.959) | |

| Top3 | −0.607*** | −0.397*** | −0.292*** | −0.588*** | −0.411*** | −0.386*** | −0.649*** |

| (−6.593) | (−4.666) | (−3.346) | (−4.509) | (−3.558) | (−4.604) | (−7.445) | |

| Quick | −0.010*** | 0.003 | −0.008* | −0.009** | −0.007* | −0.013** | −0.010*** |

| (−2.955) | (1.040) | (−1.916) | (−2.085) | (−1.676) | (−2.476) | (−2.877) | |

| Mfee | −2.872 | 1.998 | 1.226 | −7.927** | 0.009 | −2.157* | −5.353 |

| (−1.380) | (0.614) | (1.360) | (−2.257) | (1.439) | (−1.833) | (−1.114) | |

| Fixed | −0.211*** | −0.023 | −0.077 | −0.147* | −0.233** | −0.096* | −0.127** |

| (−3.547) | (−0.466) | (−1.130) | (−1.797) | (−2.358) | (−1.672) | (−2.297) | |

| AuditFee | 0.098*** | 0.018 | 0.064* | 0.093** | 0.020 | 0.118*** | 0.071*** |

| (4.569) | (0.843) | (1.917) | (2.509) | (0.689) | (4.092) | (3.351) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −3.314*** | −2.940*** | −2.888*** | −4.058*** | −2.782*** | −2.692*** | −3.557*** |

| (−10.153) | (−6.936) | (−5.370) | (−7.714) | (−6.712) | (−6.768) | (−11.270) | |

| N | 16,327 | 10,155 | 11,837 | 17,430 | 2,872 | 4,921 | 18,802 |

| Adj. R2 | 0.653 | 0.598 | 0.149 | 0.254 | 0.632 | 0.616 | 0.642 |

Notes:

The heterogeneity test table of the empirical analysis section of this article.

***, **, * indicate significance at the levels of 0.01, 0.05, and 0.1, respectively.

| Type of business | Technology-intensive | Asset-intensive | Labor-intensive |

|---|---|---|---|

| Segment industry code | N77 C36 M74165 C33 C35 C27 C29 C39 C38 C37 C41 C40 | G56 D44 A04 B11 D45 B07 C22 C31 G55 C30 R86 C28 C26 C25 | A01 A02 A03 A05 BO6 BO8 BO9 C13 C14C15 C17 C18 C19 C20 C21 C23 C24 C32 C34 D46 E48 E49 E50 F51 F52 G53 G54 G58 G59163164 K70 L72 M73 M75 N78 P82 R85 R87 S90 |

| Number of samples | 1,415 | 651 | 1,173 |

Notes:

Classification table of enterprises based on production factors of the empirical analysis section of this article.

The subdivision industry code comes from the China Securities Regulatory Commission (2021), and the classification results are obtained through cluster analysis.

| (1) Technology-intensive | (2) Labor-intensive | (3) Asset-intensive | |

|---|---|---|---|

| AI | AI | AI | |

| IT | 0.095*** | 0.081* | −0.005 |

| (3.398) | (1.807) | (−0.135) | |

| Size | 0.159*** | 0.101*** | 0.055*** |

| (8.574) | (7.411) | (3.935) | |

| BM | −0.054 | 0.027 | 0.028 |

| (−1.280) | (0.802) | (0.782) | |

| ROA | −0.042 | −0.057 | −0.027 |

| (−0.697) | (−1.559) | (−0.453) | |

| Mshare | −0.001 | 0.001 | −0.000 |

| (−1.510) | (0.707) | (−0.285) | |

| Gross Profit | −0.182** | 0.020 | −0.075 |

| (−2.362) | (0.480) | (−1.533) | |

| Top3 | −0.603*** | −0.461*** | −0.062 |

| (−6.254) | (−6.828) | (−0.887) | |

| Quick | −0.008** | −0.008*** | −0.008** |

| (−2.166) | (−2.774) | (−2.513) | |

| Mfee | −8.369** | 1.068 | −0.813 |

| (−2.060) | (1.355) | (−0.605) | |

| Fixed | −0.106 | −0.068 | −0.209*** |

| (−1.330) | (−1.203) | (−3.680) | |

| AuditFee | 0.090*** | 0.058*** | 0.015 |

| (3.324) | (2.701) | (0.716) | |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Constant | −3.744*** | −2.618*** | −1.223*** |

| (−9.406) | (−8.703) | (−4.179) | |

| N | 13253 | 10042 | 5281 |

| Adj. R2 | 0.679 | 0.525 | 0.342 |

Notes:

The influence of external factors of the empirical analysis section of this article.

***, **, * indicate significance at the levels of 0.01, 0.05, and 0.1, respectively.

Conclusions

In March 2024, during the UN conference on the global resolution on AI, there was a strong emphasis on addressing structural imbalances in AI and digital technologies. Given the pronounced geopolitical asymmetry in global technological development, developing countries are facing systemic barriers in pursuing digital infrastructure, technological capabilities, and regulatory frameworks. The technological divide in AI has emerged as a critical barrier to achieving the Sustainable Development Goals. Exploring a development path for artificial intelligence in China that aligns with international standards, fully and faithfully applying the new development philosophy, accelerating the creation of a new development pattern, and promoting high-quality development are the responsibilities and missions of Chinese enterprises on the international stage. However, enhancing the digital background of executives poses a common challenge in the AI development of enterprises. Thus, it is imperative to investigate the impact of executives’ digital backgrounds on AI. This study seeks to determine whether executives’ digital backgrounds can elevate the level of AI utilization in enterprises and, if so, how they influence it. Based on this, this article takes Chinese A-share listed companies in Shanghai and Shenzhen from 2012 to 2022 as the research object, and explores the impact and mechanism of executive digital background on the level of artificial intelligence utilization in enterprises. Research has found that firstly, having a significant number of executives with digital backgrounds can significantly promote the development of artificial intelligence utilization in companies. Secondly, the impact of executive digital background on the utilization level of artificial intelligence in enterprises is regulated by improving the total factor productivity of the enterprise. Thirdly, the digital back-ground of executives enhances the level of artificial intelligence utilization by improving their ability to apply digital technology. Fourthly, based on the heterogeneity of enterprise property rights, different regions, and technological levels, heterogeneity analysis shows that the positive impact of digital background of enterprise executives on the utilization level of artificial intelligence is stronger in private enterprises and slightly weaker in state-owned enterprises; The results of regional heterogeneity analysis indicate that the impact of executive digital background on the utilization level of artificial intelligence in enterprises gradually weakens from the eastern region to the central and western regions. After key variable replacement, model replacement, instrumental variable method, and Heckman two-stage method, the above research results remain robust.

Reflecting on the past and anticipating the future, to propel the quality and efficiency of the Chinese economy and elevate AI utilization in enterprises, it is crucial to guide enterprises in enhancing AI utilization, ensuring effective fund allocation, improving fund utilization rates, and mitigating information asymmetry. Firms should harness the digital backgrounds of their executives to advance AI utilization. Simultaneously, the government should intervene appropriately, actively guiding enterprises in developing AI utilization and optimizing resource allocation efficiency. This article examines the relationship between executives’ digital backgrounds and the level of artificial intelligence utilization in enterprises from both theoretical and empirical perspectives, providing useful theoretical references for the development of executive digital background and the improvement of enterprise artificial intelligence utilization in the future.

The study acknowledges its limitations. The research primarily focuses on two key channels: total factor productivity and digital technology application capabilities of enterprises. However, in the broader context of the real economy, executives’ digital backgrounds influence the utilization of AI through additional channels, providing avenues for future research. Based on the Chinese context, the study finds that executives’ digital backgrounds enhance AI utilization. Despite these findings, limitations remain due to sample selection bias and cultural embeddedness, which affect the cross-national applicability of the results. Future research should develop a cross-cultural analytical framework to explore these effects more comprehensively under varying environmental conditions.